知识图谱存储方式主要包含资源描述框架(Resource Description Framework,RDF)和图数据库(Graph Database)。

资源描述框架特性:

图数据库特性:

进入neo4j目录

cd neo4j/bin

./neo4j start

启动成功,终端会提示:

Starting Neo4j.Started neo4j (pid 30914). It is available at http://localhost:7474/ There may be a short delay until the server is ready.

启动前注意本地已安装JDK(建议安装JDK版本11):https://www.oracle.com/java/technologies/javase-downloads.html

完成安装JDK1.8.0_261后,在启动neo4j过程中出现了以下问题:

Unable to find any JVMs matching version "11"

解决:提示安装jdk 11 version,于是下载了jdk-11.0.8,Mac OS可通过ls -la /Library/Java/JavaVirtualMachines/查看已安装的jdk及版本信息。

免费开源金融数据接口:

a. Tushare: http://www.tushare.org

b. JointQuant: https://www.joinquant.com/

import tushare as ts

import csv

import time

import pandas as pd

# 以下pro_api token可能已过期,可自行前往申请或者使用免费版本

pro = ts.pro_api('4340a981b3102106757287c11833fc14e310c4bacf8275f067c9b82d')

stock_basic = pro.stock_basic(list_status='L', fields='ts_code, symbol, name, industry')

# 重命名行,便于后面导入neo4j

basic_rename = {'ts_code': 'TS代码', 'symbol': '股票代码', 'name': '股票名称', 'industry': '行业'}

stock_basic.rename(columns=basic_rename, inplace=True)

# 保存为stock_basic.csv

stock_basic.to_csv('financial_data\\stock_basic.csv', encoding='gbk')

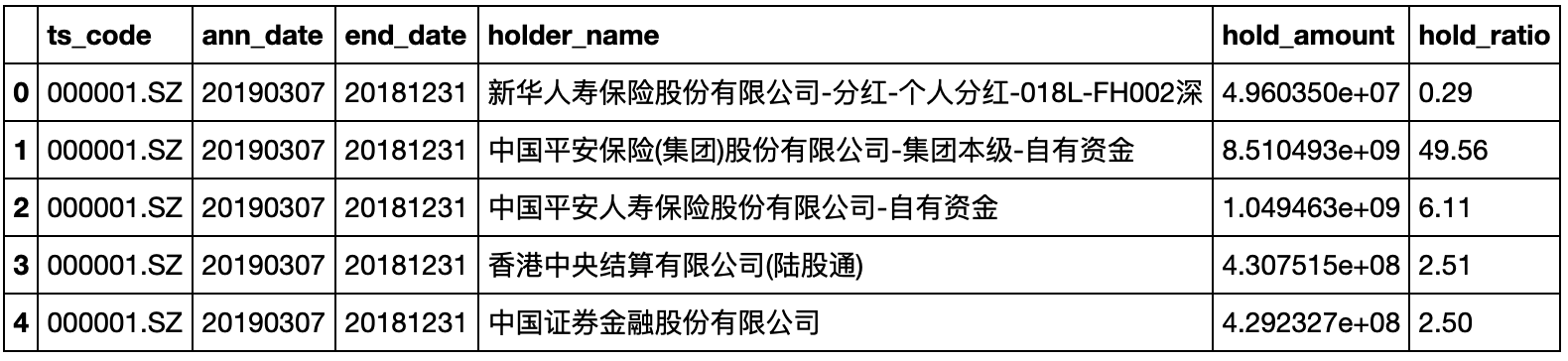

holders = pd.DataFrame(columns=('ts_code', 'ann_date', 'end_date', 'holder_name', 'hold_amount', 'hold_ratio'))

# 获取一年内所有上市股票股东信息(可以获取一个报告期的)

for i in range(3610):

code = stock_basic['TS代码'].values[i]

holders = pro.top10_holders(ts_code=code, start_date='20180101', end_date='20181231')

holders = holders.append(holders)

if i % 600 == 0:

print(i)

time.sleep(0.4)# 数据接口限制

# 保存为stock_holders.csv

holders.to_csv('financial_data\\stock_holders.csv', encoding='gbk')

holders = pro.holders(ts_code='000001.SZ', start_date='20180101', end_date='20181231')

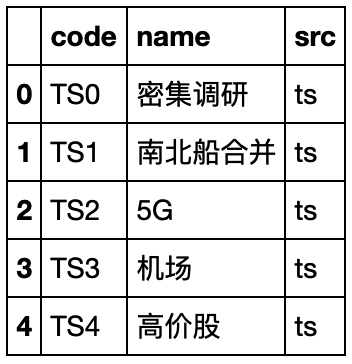

concept_details = pd.DataFrame(columns=('id', 'concept_name', 'ts_code', 'name'))

for i in range(358):

id = 'TS' + str(i)

concept_detail = pro.concept_detail(id=id)

concept_details = concept_details.append(concept_detail)

time.sleep(0.4)

# 保存为concept_detail.csv

concept_details.to_csv('financial_data\\stock_concept.csv', encoding='gbk')

for i in range(3610):

code = stock_basic['TS代码'].values[i]

notices = pro.anns(ts_code=code, start_date='20180101', end_date='20181231', year='2018')

notices.to_csv("financial_data\\notices\\"+str(code)+".csv",encoding='utf_8_sig',index=False)

notices = pro.anns(ts_code='000001.SZ', start_date='20180101', end_date='20181231', year='2018')

news = pro.news(src='sina', start_date='20180101', end_date='20181231')

news.to_csv("financial_data\\news.csv",encoding='utf_8_sig')

concept = pro.concept()

concept.to_csv('financial_data\\concept.csv', encoding='gbk')

#获取沪股通成分

sh = pro.hs_const(hs_type='SH')

sh.to_csv("financial_data\\sh.csv",index=False)

#获取深股通成分

sz = pro.hs_const(hs_type='SZ')

sz.to_csv("financial_data\\sz.csv",index=False)

for i in range(3610):

code = stock_basic['TS代码'].values[i]

price = pro.query('daily', ts_code=code, start_date='20180101', end_date='20181231')

price.to_csv("financial_data\\price\\"+str(code)+".csv",index=False)

# 基本面信息

df = ts.get_stock_basics()

# 公告信息

ts.get_notices("000001")

# 新浪股吧

ts.guba_sina()

# 历史价格数据

ts.get_hist_data("000001")

# 历史价格数据(周粒度)

ts.get_hist_data("000001",ktype="w")

# 历史价格数据(1分钟粒度)

ts.get_hist_data("000001",ktype="m")

# 历史价格数据(5分钟粒度)

ts.get_hist_data("000001",ktype="5")

# 指数数据(sh上证指数;sz深圳成指;hs300沪深300;sz50上证50;zxb中小板指数;cyb创业板指数)

ts.get_hist_data("cyb")

# 宏观数据(居民消费指数)

ts.get_cpi()

# 获取分笔数据

ts.get_tick_data('000001', date='2018-10-08', src='tt')

import numpy as np

yaxis = list()

for i in listdir:

stock = pd.read_csv("financial_data\\price_logreturn\\"+i)

yaxis.append(len(stock['logreturn']))

counts = np.bincount(yaxis)

np.argmax(counts)

股票对数收益及皮尔逊相关系数的计算公式:

import pandas as pd

import numpy as np

import os

import math

listdir = os.listdir("financial_data\\price")

for l in listdir:

stock = pd.read_csv('financial_data\\price\\'+l)

stock['index'] = [1]* len(stock['close'])

stock['next_close'] = stock.groupby('index')['close'].shift(-1)

stock = stock.drop(index=stock.index[-1])

logreturn = list()

for i in stock.index:

logreturn.append(math.log(stock['next_close'][i]/stock['close'][i]))

stock['logreturn'] = logreturn

stock.to_csv("financial_data\\price_logreturn\\"+l,index=False)

from math import sqrt

def multipl(a,b):

sumofab=0.0

for i in range(len(a)):

temp=a[i]*b[i]

sumofab+=temp

return sumofab

def corrcoef(x,y):

n=len(x)

#求和

sum1=sum(x)

sum2=sum(y)

#求乘积之和

sumofxy=multipl(x,y)

#求平方和

sumofx2 = sum([pow(i,2) for i in x])

sumofy2 = sum([pow(j,2) for j in y])

num=sumofxy-(float(sum1)*float(sum2)/n)

#计算皮尔逊相关系数

den=sqrt((sumofx2-float(sum1**2)/n)*(sumofy2-float(sum2**2)/n))

return num/den

由于原始数据达百万条,为节省计算量仅选取前300个股票进行关联性分析

listdir = os.listdir("financial_data\\300stock_logreturn")

s1 = list()

s2 = list()

corr = list()

for i in listdir:

for j in listdir:

stocka = pd.read_csv("financial_data\\300stock_logreturn\\"+i)

stockb = pd.read_csv("financial_data\\300stock_logreturn\\"+j)

if len(stocka['logreturn']) == 242 and len(stockb['logreturn']) == 242:

s1.append(str(i)[:10])

s2.append(str(j)[:10])

corr.append(corrcoef(stocka['logreturn'],stockb['logreturn']))

print(str(i)[:10],str(j)[:10],corrcoef(stocka['logreturn'],stockb['logreturn']))

corrdf = pd.DataFrame()

corrdf['s1'] = s1

corrdf['s2'] = s2

corrdf['corr'] = corr

corrdf.to_csv("financial_data\\corr.csv")

具体代码可参考3.1 python操作neo4j-连接

from pandas import DataFrame

from py2neo import Graph,Node,Relationship,NodeMatcher

import pandas as pd

import numpy as np

import os

# 连接Neo4j数据库

graph = Graph('http://localhost:7474/db/data/',username='neo4j',password='neo4j')

stock = pd.read_csv('stock_basic.csv',encoding="gbk")

holder = pd.read_csv('holders.csv')

concept_num = pd.read_csv('concept.csv')

concept = pd.read_csv('stock_concept.csv')

sh = pd.read_csv('sh.csv')

sz = pd.read_csv('sz.csv')

corr = pd.read_csv('corr.csv')

stock['行业'] = stock['行业'].fillna('未知')

holder = holder.drop_duplicates(subset=None, keep='first', inplace=False)

概念、股票、股东、股通

sz = Node('深股通',名字='深股通')

graph.create(sz)

sh = Node('沪股通',名字='沪股通')

graph.create(sh)

for i in concept_num.values:

a = Node('概念',概念代码=i[1],概念名称=i[2])

print('概念代码:'+str(i[1]),'概念名称:'+str(i[2]))

graph.create(a)

for i in stock.values:

a = Node('股票',TS代码=i[1],股票名称=i[3],行业=i[4])

print('TS代码:'+str(i[1]),'股票名称:'+str(i[3]),'行业:'+str(i[4]))

graph.create(a)

for i in holder.values:

a = Node('股东',TS代码=i[0],股东名称=i[1],持股数量=i[2],持股比例=i[3])

print('TS代码:'+str(i[0]),'股东名称:'+str(i[1]),'持股数量:'+str(i[2]))

graph.create(a)

股票-股东、股票-概念、股票-公告、股票-股通

matcher = NodeMatcher(graph)

for i in holder.values:

a = matcher.match("股票",TS代码=i[0]).first()

b = matcher.match("股东",TS代码=i[0])

for j in b:

r = Relationship(j,'参股',a)

graph.create(r)

print('TS',str(i[0]))

for i in concept.values:

a = matcher.match("股票",TS代码=i[3]).first()

b = matcher.match("概念",概念代码=i[1]).first()

if a == None or b == None:

continue

r = Relationship(a,'概念属于',b)

graph.create(r)

noticesdir = os.listdir("notices\\")

for n in noticesdir:

notice = pd.read_csv("notices\\"+n,encoding="utf_8_sig")

notice['content'] = notice['content'].fillna('空白')

for i in notice.values:

a = matcher.match("股票",TS代码=i[0]).first()

b = Node('公告',日期=i[1],标题=i[2],内容=i[3])

graph.create(b)

r = Relationship(a,'发布公告',b)

graph.create(r)

print(str(i[0]))

for i in sz.values:

a = matcher.match("股票",TS代码=i[0]).first()

b = matcher.match("深股通").first()

r = Relationship(a,'成分股属于',b)

graph.create(r)

print('TS代码:'+str(i[1]),'--深股通')

for i in sh.values:

a = matcher.match("股票",TS代码=i[0]).first()

b = matcher.match("沪股通").first()

r = Relationship(a,'成分股属于',b)

graph.create(r)

print('TS代码:'+str(i[1]),'--沪股通')

# 构建股票间关联

corr = pd.read_csv("corr.csv")

for i in corr.values:

a = matcher.match("股票",TS代码=i[1][:-1]).first()

b = matcher.match("股票",TS代码=i[2][:-1]).first()

r = Relationship(a,str(i[3]),b)

graph.create(r)

print(i)

基于Crypher语言

PageRank (页面排名)

ArticleRank

Betweenness Centrality (中介中心度)

Closeness Centrality (接近中心度)

Harmonic Centrality

Louvain (鲁汶算法)

Label Propagation (标签传播)

Connected Components (连通组件)

Strongly Connected Components (强连通组件)

Triangle Counting / Clustering Coefficient (三角计数/聚类系数)

Minimum Weight Spanning Tree (最小权重生成树)

Shortest Path (最短路径)

Single Source Shortest Path (单源最短路径)

All Pairs Shortest Path (全顶点对最短路径)

A*

Yen’s K-shortest paths

Random Walk (随机漫步)

Jaccard Similarity (Jaccard相似度)

Cosine Similarity (余弦相似度)

Pearson Similarity (Pearson相似度)

Euclidean Distance (欧氏距离)

Overlap Similarity (重叠相似度)

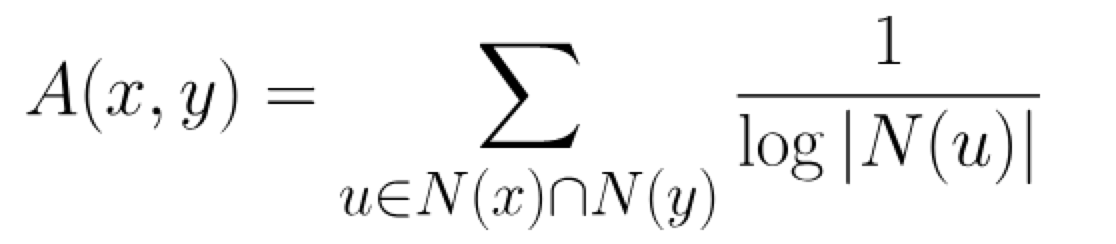

Adamic Adar

Common Neighbors

Preferential Attachment

Resource Allocation

Same Community

Total Neighbors

(1)下载graph-algorithms-algo-3.5.4.0.jar复制到对应数据库的plugin文件夹下

(2)修改数据库目录下的conf中neo4j.conf,添加dbms.security.procedures.unrestricted=algo.*

实践neo4j的链路预测算法(Aaamic Adar algorithm, AAA):主要基于判断相邻的两个节点之间的亲密程度作为评判标准

算法实践:

MERGE (zhen:Person {name: "Zhen"})

MERGE (praveena:Person {name: "Praveena"})

MERGE (michael:Person {name: "Michael"})

MERGE (arya:Person {name: "Arya"})

MERGE (karin:Person {name: "Karin"})

MERGE (zhen)-[:FRIENDS]-(arya)

MERGE (zhen)-[:FRIENDS]-(praveena)

MERGE (praveena)-[:WORKS_WITH]-(karin)

MERGE (praveena)-[:FRIENDS]-(michael)

MERGE (michael)-[:WORKS_WITH]-(karin)

MERGE (arya)-[:FRIENDS]-(karin)

MATCH (p1:Person {name: 'Michael'})

MATCH (p2:Person {name: 'Karin'})

RETURN algo.linkprediction.adamicAdar(p1, p2) AS score

// score: 0.910349

MATCH (p1:Person {name: 'Michael'})

MATCH (p2:Person {name: 'Karin'})

RETURN algo.linkprediction.adamicAdar(p1, p2, {relationshipQuery: "FRIENDS"}) AS score

// score: 0.0

此处可能存在不合适展示的内容,页面不予展示。您可通过相关编辑功能自查并修改。

如您确认内容无涉及 不当用语 / 纯广告导流 / 暴力 / 低俗色情 / 侵权 / 盗版 / 虚假 / 无价值内容或违法国家有关法律法规的内容,可点击提交进行申诉,我们将尽快为您处理。